49+ can you write off interest paid on your mortgage

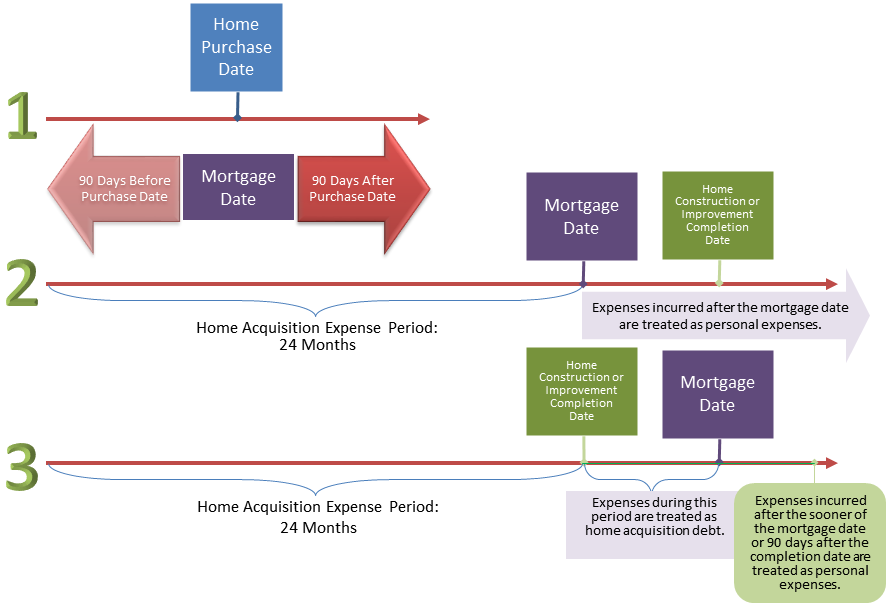

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to.

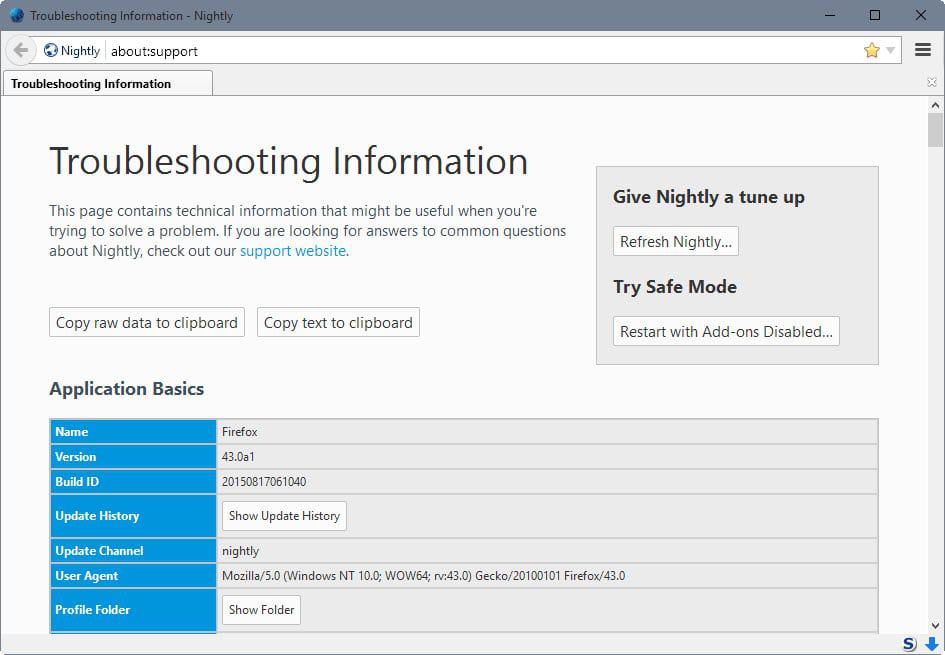

A Comprehensive List Of Firefox Privacy And Security Settings Ghacks Tech News

Ad How Much Interest Can You Save by Increasing Your Mortgage Payment.

. Web Among the numerous benefits of home ownership are some nifty tax deductions. Create Your Satisfaction of Mortgage. Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098.

If you cant take tax deductions for buying a house in the year the closing costs are paid you still may be. Web Taxpayers who took out a mortgage after Dec. If your name is on the title and youre also paying the mortgage theres no problem claiming the deduction.

Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. As noted in general you can deduct the. Ad Developed by Lawyers.

Its when someone else makes the payment that things. 15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. The limit is 375000 for married couples filing separate.

If you are single or married and. Web Most homeowners can deduct all of their mortgage interest. LawDepot Has You Covered with a Wide Variety of Legal Documents.

Web Closing costs that can be deducted over the life of your loan. Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Web The tax benefit for mortgage interest deductions will be 750000 for this years tax year which means a home buyer will be able to deduct the interest paid on up.

Web So if you have a mortgage keep good records the interest youre paying on your home loan could help cut your tax bill. If you took out a mortgage to purchase your home you can write off the mortgage interest you. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

P5 Jpg

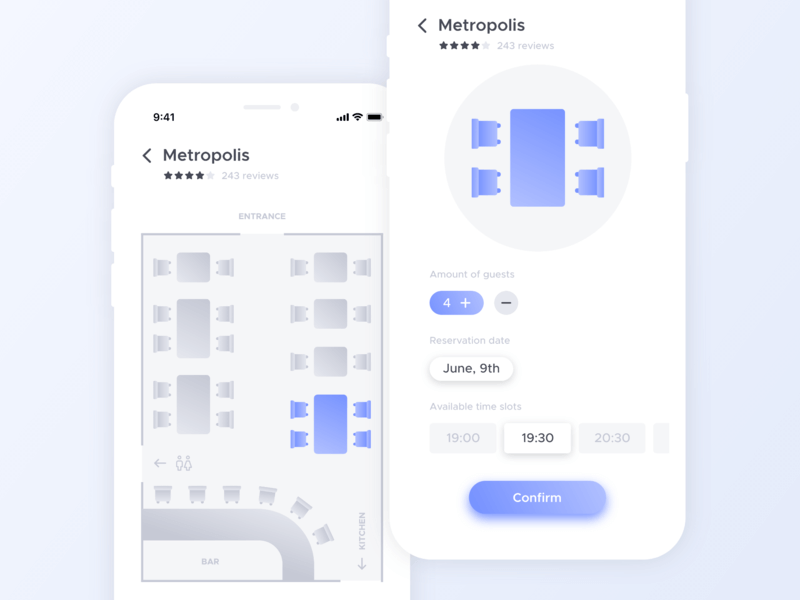

49 Mobile App Ideas That Haven T Been Made 2023 Update

The Trucker Clogs In A Bad Way Direct From Denmark

49 Mobile App Ideas That Haven T Been Made 2023 Update

Verification Letter 20 Examples Format Sample Examples

Are Your Mortgage Payments Tax Deductible In 2022

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Mortgage Interest Deduction How It Calculate Tax Savings

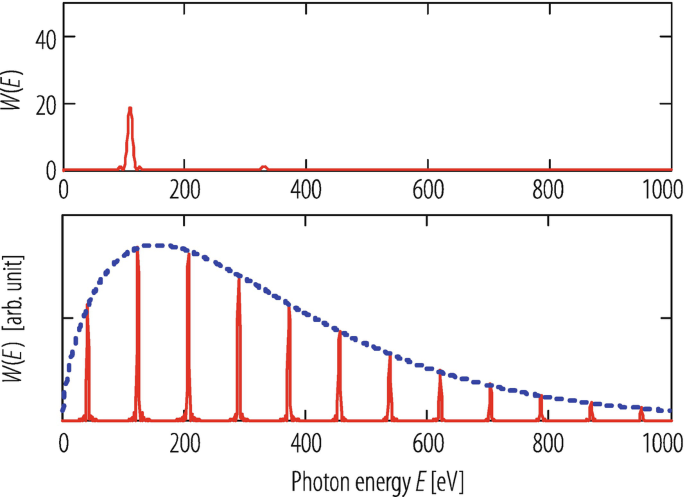

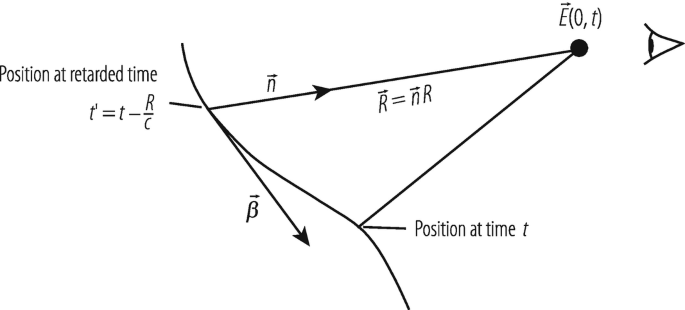

Application Of Accelerators And Storage Rings Springerlink

15 Best Mortgage Brokers In Ireland 2023 Heydublin

The Practicing Writer 2 0 February 2022

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Sgd Inr Crosses 50 Aditya Ladia

Ekaterinburg And Sverdlovsk Region Marchmont Capital Partners

The Home Mortgage Interest Deduction Lendingtree

Solved A Friend Plans To Purchase A 55 Inch Tv At A Particular Store At An Course Hero

Application Of Accelerators And Storage Rings Springerlink